Beginning university for the first time can be challenging. Whether you live with family, or in halls, you will find yourself budgeting throughout your student days. Politics and International Relations student Terrelle Iziren offers advice on how to stay savvy, and give your finance a leg up as a student.

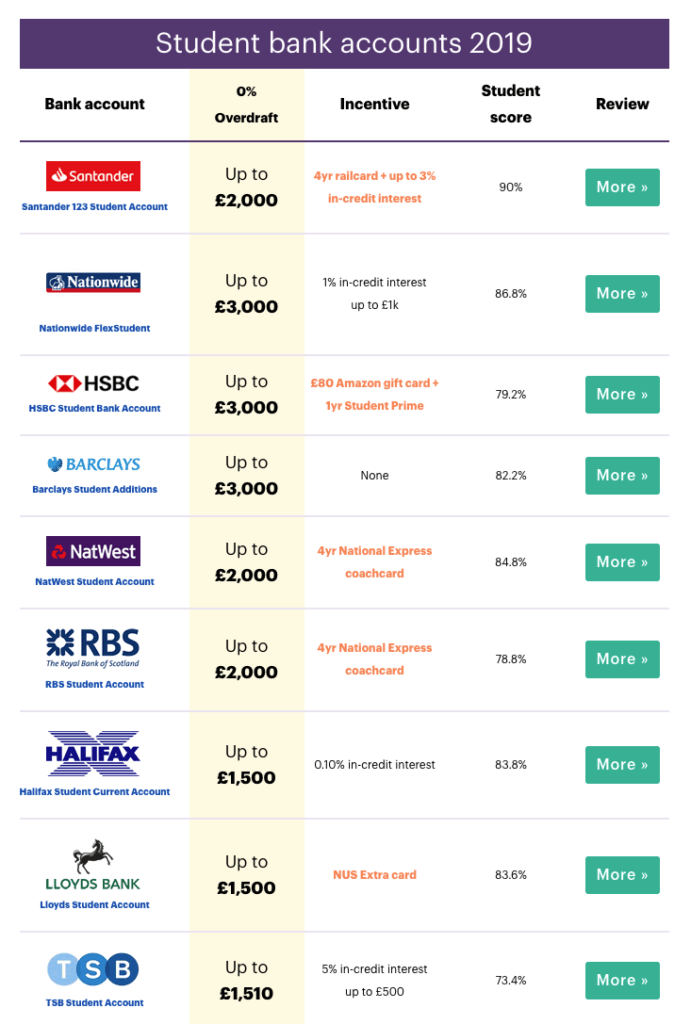

Student Bank Accounts

Many student accounts are created exclusively for university students, and only require photo ID (passport or driving license), as well as a proof of address, and of student status. Don’t be lured in by freebies like Amazon gift cards or Cash rewards – keep your eyes peeled for the account that gives you the largest overdraft with the lowest interest rates. Many university campuses have on-site banks so you won’t have to travel far to sign up. Save the Student has a list of the leading Student Accounts currently available.

Young Person’s Railcards

These are travel gold. If you’re planning on studying in a different part of the UK to where you currently live, you can get up to 30% off your travel. With two cards available to 16-26 and 26-30 year-olds, they are also accessible to mature students. If you’re studying in London, you can even add your railcard to your oyster card to get a further discount ever time your tap in.

National Express Coachcard

If trains aren’t your style, why not try a Coachcard? National Express offer Young Person’s Coachcard holders (16-26 year-olds) 1/3 off standard fares. This costs £12.50 per year, or £30 for three years, which covers the majority of your time at university.

Online-only banks

Starling bank is completely app-based, allowing students to earn up to 0.5% interest with account balances up to £2,000. Starling offers things many traditional banks don’t, giving you instant feedback on purchases, and making budgeting easier by organising transactions into categories like shopping, bills, travel, and hobbies. App-based banks like Starling Bank and Monzo are protected by the Financial Services Compensation Scheme (FSCS), which means up to £85,000 of your money is protected if the bank goes bankrupt.

Supermarket Downshift

The cost of your weekly shop can vary depending on where you shop. In 2018, Which.com found Morrisons to be the cheapest of six supermarkets for the second year in a row, followed by ASDA, Sainsbury’s, TESCO, Ocado, and finally Waitrose. Buying own brand can also help you find better value. For example, 125g of branded mackerel fillets costs £1.40 in Sainsbury’s, whereas the Sainsbury’s own brand fillets cost 90p. It is also worth checking out more budget supermarkets like Aldi or Lidl for great value at lower prices.

Now you’re ready to begin your first year at university. Check out the Goldsmiths student centre if you have any questions, and remember that first-year students reapply for student finance in March 2020.